The Gut Punch Weekly #6

Hims slams pharma in Super Bowl ad, most GLP-1 patients discontinue treatment, exenatide fails to treat Parkinson's, PepsiCo shifts to healthier snacking, and more!

The Ozempic Era, Part III: The Deal with the Devil

The true cost of anti-obesity medications extends far beyond their hefty price tag. Up to one-third of patients’ weight loss comes from lean muscle tissue rather than fat, severely impairing their metabolic “furnace.” When treatment ends – whether from patient fatigue, insurance denial, or unmanageable costs – the body is thrown off balance. Patients experience a perfect storm of metabolic maladaptation:

Junk food cravings return with a vengeance,

Diminished muscle mass means a lower resting metabolic rate and reduced calorie burning potential, and

Weight rebounds as their bodies, unable to cope with the sudden excess of junk calories, store this energy as fat.

The toll is brutal: this cycle often leaves patients not only heavier than before but metabolically and psychologically damaged.

Their bodies, having lost critical muscle mass and gained proportionally more fat, are even less equipped to maintain a healthy weight.

Their confidence in medical interventions is shattered.

Their financial resources are depleted.

And perhaps most cruelly, their brief taste of freedom from food addiction makes their return to old patterns all the more painful.

Why are the alluring promises of miracle weight loss drugs failing to manifest for so many patients?

Our sickcare system may be luring GLP-1 patients into a health trap.

Read more in The Ozempic Era, Part III: The Deal with the Devil.

Top Stories

1) Hims & Hers Slams Big Pharma in Bold Super Bowl Ad

Hims & Hers launched a provocative Super Bowl ad criticizing the pharmaceutical industry's pricing of weight-loss medications.

The ad highlights the high costs of drugs like Wegovy and Zepbound, which can exceed $1,000 per month.

The commercial criticizes the $160 billion weight-loss industry for prioritizing profits over the welfare of the nearly 74% of American adults who are overweight or obese.

The telehealth company offers compounded GLP-1 medications at a lower price point ($165/month), positioning itself as an alternative to expensive brand-name drugs.

However, these compounded drugs are not FDA-approved, raising significant safety concerns.

(Fortune)

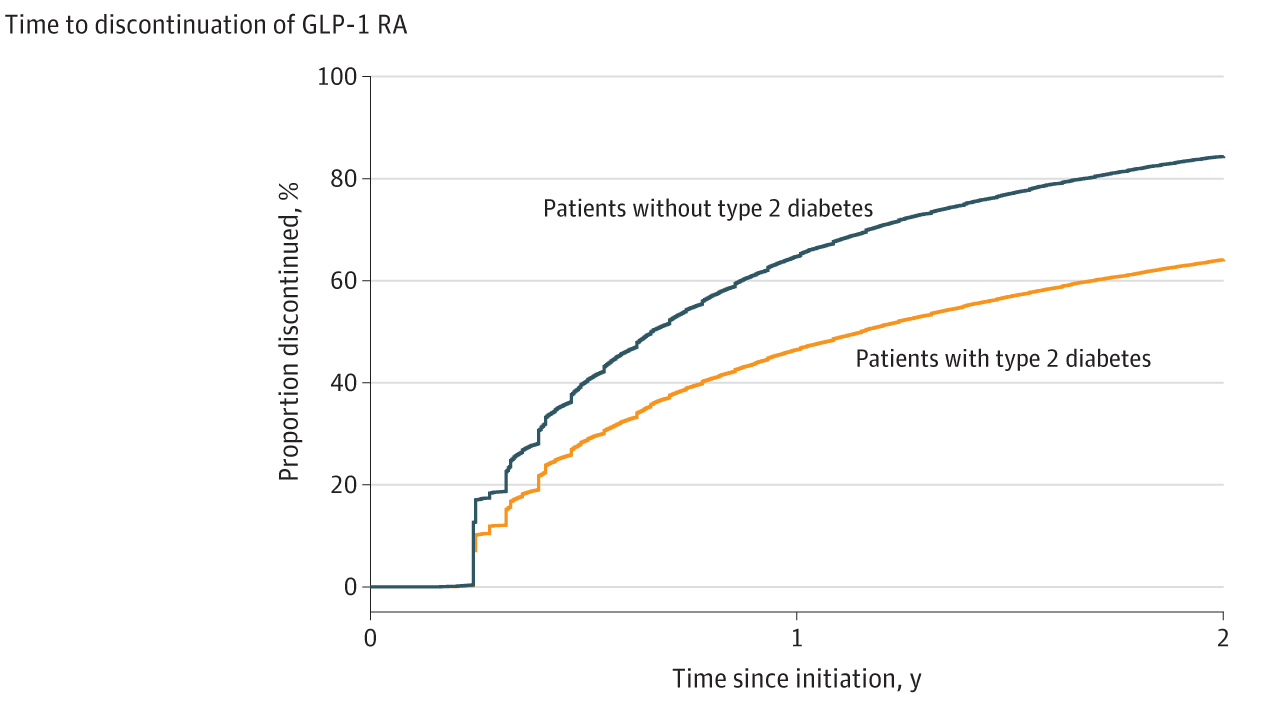

2) Study Reveals GLP-1 Medication Discontinuation Trends

Truveta's comprehensive study of GLP-1 receptor agonist medications reveals significant disparities in treatment discontinuation based on type 2 diabetes status, income levels, and weight changes.

Patients without type 2 diabetes are more likely to stop medication, with 64.8% discontinuing within one year compared to 46.5% of those with the condition.

Gastrointestinal side effects and income levels significantly influence medication continuation, with higher-income patients more likely to maintain treatment.

The research reveals critical barriers to sustained GLP-1 medication use, emphasizing the need for improved access, affordability, and personalized treatment strategies to address obesity and diabetes management.

3) Ozempic-Like Drug Fails to Treat Parkinson's

A comprehensive UK study found that exenatide, a GLP-1 drug akin to Ozempic, failed to demonstrate any therapeutic benefits for Parkinson's disease patients over a 96-week period. The study showed no improvements in symptoms, disease progression, or brain imaging.

Despite promising preliminary studies and epidemiological data suggesting GLP-1 drugs might protect against Parkinson's, this comprehensive trial found no positive effects on patient outcomes or brain scans.

Experts described the results as 'hugely disappointing' and 'sobering'.

These findings may dampen optimism about using newer weight-loss drugs to treat other neurological diseases, including potential investigations into Alzheimer's prevention and treatment.

(NYTimes)

4) PepsiCo Shifts Strategy to Healthier Snack Options

PepsiCo has seen salty snack volumes decline for five consecutive quarters as customers become more focused on nutritional content and functional food benefits.

In response to changing consumer preferences, the company is pivoting towards healthier snack options with lower sodium, reduced fat, fewer artificial ingredients, and added functional benefits like protein and whole grains.

Executives are further adapting their strategy by offering smaller portion sizes, adding protein to products, and exploring acquisitions like the full ownership of Sabra Dipping to meet evolving consumer demands.

PepsiCo's CEO Ramon Laguarta maintains that weight-loss drugs like Ozempic have minimal business impact, though research suggests households using these medications spend less on processed snacks.

(NYTimes)

5) Half of Americans Support Medicare GLP-1 Drug Coverage

The AP-NORC poll indicates strong public support for weight loss medications when used to address medical conditions, with 54% of adults endorsing their use for obesity treatment.

Public support dramatically decreases when considering weight loss drug use for cosmetic purposes, with minimal backing for prescribing these medications to adults (12%) or teenagers (8%) without obesity or weight-related health issues.

Approximately half of Americans support Medicare and Medicaid coverage of these weight loss drugs, with Democrats showing more enthusiasm for the proposal than Republicans or independents.

The Biden administration had proposed mandating Medicaid coverage for GLP-1 medications.

(AP-NORC)

6) Noom Cuts Staff to Focus on GLP-1 Products

Noom, a digital weight loss company, has confirmed layoffs as part of a strategic restructuring to focus on more critical business areas, particularly its rapidly growing GLP-1-related products.

Noom is pivoting towards GLP-1-related products and expanding its digital enterprise offerings, including Noom Med, a clinical obesity management solution that provides psychological tools and clinician support.

The company emphasized that this decision was made to improve business efficiency and position itself as a leader in the health and wellness space.

By shifting its business model and investing in innovative health technologies, Noom aims to maintain its competitive edge in the rapidly evolving digital health and weight management landscape.

GLP-1 Industry Intel

Novo Nordisk Pushes to Block Drug Price Controls: Novo Nordisk is seeking to expedite its legal challenge against the Inflation Reduction Act's drug price negotiation program, arguing its three key drugs — Ozempic, Wegovy, and Rybelsus — shouldn't be included in the second round of potential price negotiations.

New Setback for Amgen in Weight Loss Market: Amgen's obesity drug pipeline faces another challenge as the FDA placed a clinical hold on its early-stage candidate AMG 513, following earlier disappointing results with its MariTide candidate.

Diabetes Device Maker Pivots to Obesity Treatment: After laying off 17% of its staff, medical device company Fractyl Health is pausing diabetes studies, pivoting toward obesity research, and developing an intestinal-relining procedure as a potential 'off-ramp' for GLP-1 medication users.

Food & Wellness Industry Intel

Supplement Industry Attempts to Ride GLP-1 Drugs' Coattails: The supplement industry is launching 'natural Ozempic' alternatives like berberine and taurine, which may offer modest metabolic benefits but lack the robust weight loss effects of prescription GLP-1 drugs.

Investors Predict GLP-1 Drugs Reshape Wellness Product Landscape: Venture capitalists predict a wellness market shift in 2025 focused on straightforward ingredient labels, nutrient-dense foods, and products tailored to GLP-1 medication users.

Digital Health Firms Targeting GLP-1 Drug Costs: As GLP-1 drug costs skyrocket, digital health firms like Teladoc and Omada are developing companion programs to help employers manage medication expenses and patient outcomes.

Meal Delivery Service Launches Specialized Meals for GLP-1 Users: CookUnity has launched what it claims is the first chef-crafted meal collection specifically designed for GLP-1 medication users, focusing on nutrient-dense meals that support weight loss while maintaining muscle mass and nutritional balance.

Frontline Focus

Obesity Medication's Promise Fades with Weight Regain: A medical expert argues that GLP-1 weight loss drugs, while seemingly effective, ultimately create more problems than they solve by causing significant financial burden, weight cycling, and potential metabolic disruption when discontinued.

UK Tightens Online Obesity Drug Prescription Rules: Britain's General Pharmaceutical Council has tightened online prescription rules for weight-loss drugs like Wegovy and Mounjaro, mandating more rigorous patient verification processes.

Compounding Pharmacy Network Flagged for Multiple Regulatory Breaches: The FDA issued a warning letter to Prorx Pharmacy Network for multiple production breaches involving semaglutide and tirzepatide drugs, including issues with mislabeling, sterility, and insufficient side effect documentation.

New Weight Loss Drugs Rapidly Gaining Popularity: Research demonstrates a strong correlation between online search trends and prescription rates for obesity medications, with emerging drugs like semaglutide and tirzepatide dramatically changing the obesity treatment landscape.

Health Plans Confront Ozempic Costs and AI Integration: In 2025, health insurance plans are expected to confront significant challenges related to GLP-1 drug coverage and the swift, largely unregulated adoption of artificial intelligence technologies.

Older Obesity Medications Offer Alternative to GLP-1s: With GLP-1 medications in high demand but limited accessibility, medical experts suggest prescribing older, more affordable obesity medications like phentermine, metformin, and topiramate can be effective alternatives, especially when combined with behavioral interventions and personalized nutrition counseling.

RFK Jr. Calls for Overhaul of Food Ingredient Approvals: Robert F. Kennedy Jr. advocated for major FDA reforms during his HHS secretary confirmation hearing, criticizing the GRAS ingredient approval process and expressing reservations about administering GLP-1 weight loss drugs to children.

GLP-1 Drugs Reshape Bariatric Surgery Landscape: Emerging GLP-1 medications are challenging traditional bariatric surgery by providing a non-invasive, pharmaceutical option for weight loss, though long-term effectiveness remains uncertain.

GLP-1 Clinical Insights

Study Finds Weight Loss Interventions Reduce Disordered Eating: Researchers discovered that behavioral weight loss programs, with or without pharmacotherapy or psychological support, can potentially reduce disordered eating symptoms in overweight and obese individuals.

GLP-1 Drugs Show Promise for Alcohol Use Disorder: Promising preclinical and emerging human research suggesting GLP-1 receptor agonists might reduce alcohol consumption and potentially offer a novel treatment approach for alcohol use disorder.

Nausea Reduction Breakthrough for GLP-1 Weight Loss Drugs: Emerging research suggests that combining GIPR and GLP-1R agonists could reduce nausea and other side effects while preserving the therapeutic efficacy of incretin-based weight loss treatments.

The Bleeding Edge

Collagen Peptides Show Promise for Diabetes Treatment: A study found that administering collagen peptides to diabetic mice significantly reduced blood glucose levels, improved insulin sensitivity, and altered gut microbiota composition.