The Gut Punch Weekly #5

The era of cheap weight loss meds is over, Novo's new drug outshines Zepbound, GLP-1s for Alzheimer's treatment, RFK Jr. vs Dr. Oz, and more!

Top Stories

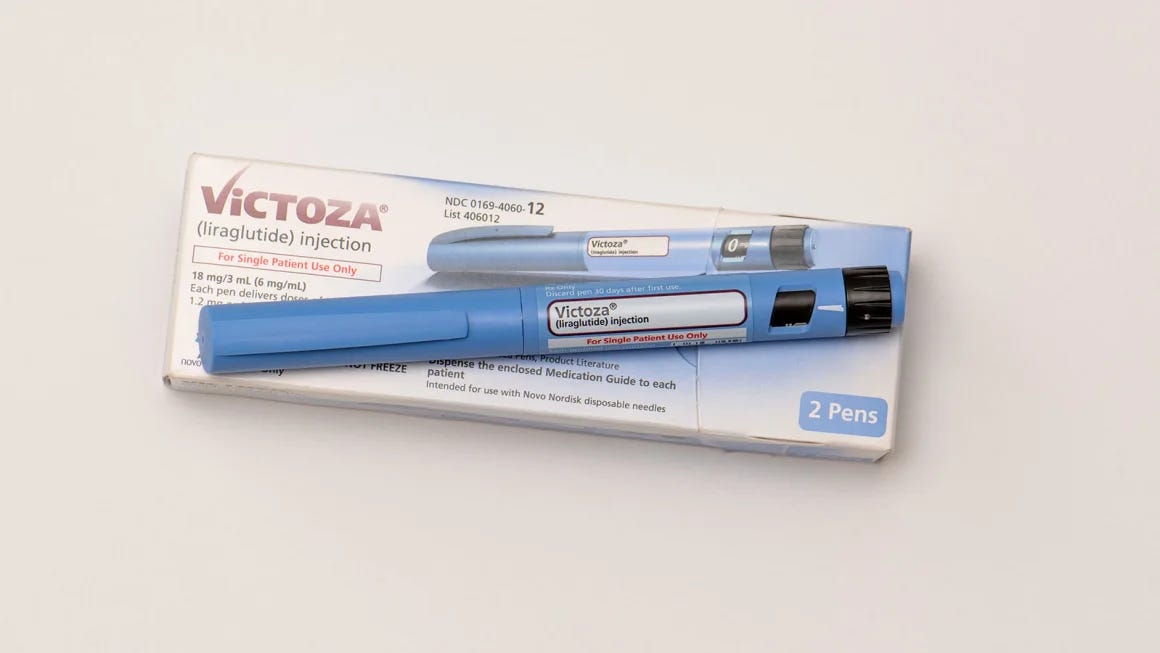

1) Cheap Weight Loss Drug Alternatives Coming to an End

The FDA is phasing out compounded versions of weight loss drugs like tirzepatide and semaglutide, effectively eliminating cheaper alternatives to brand-name medications like Ozempic and Zepbound.

Pharmaceutical companies and compounding pharmacies are engaged in a fierce battle over market access and drug pricing.

The FDA's decision highlights broader issues in the American healthcare system, including high medication costs and limited insurance coverage for obesity treatments.

Patients are caught in the middle, facing potential weight loss treatment disruptions due to financial barriers.

2) Novo's New Obesity Drug Competitive with Zepbound

Novo Nordisk's amycretin, a GLP-1 and amylin receptor agonist, showed impressive weight loss results in clinical trials, with patients losing up to 22% of their body weight after 36 weeks of treatment.

The company is exploring both subcutaneous and oral formulations of the drug, with the oral version previously demonstrating 13.1% weight loss in a 12-week study.

The drug is being developed as a potential competitor to Zepbound (Eli Lilly), which previously outperformed Novo's Wegovy in a head-to-head trial.

The drug's performance triggered a surge in Novo's stock price, offsetting losses from December after Novo's CagriSema underperformed investor expectations.

3) GLP-1 Drugs Show Promise for Alzheimer's Treatment

Emerging research suggests GLP-1 RA drugs, currently used for obesity and diabetes, may have potential to prevent and treat Alzheimer's disease by slowing cognitive decline and potentially improving brain health.

Animal studies and observational research indicate that drugs like semaglutide could lower dementia risk, with initial clinical trials showing promising results such as reduced brain shrinkage and slower cognitive decline.

Novo Nordisk is currently conducting large phase 3 clinical trials to evaluate semaglutide's effectiveness in treating early-stage Alzheimer's, which could potentially open new treatment pathways for patients without obesity or diabetes.

4) RFK Jr and Oz Clash Over Weight Loss Drug Policies

RFK Jr. and Dr. Oz represent opposing perspectives on weight loss medications, with Kennedy advocating for dietary solutions and Oz promoting pharmaceutical interventions.

Currently, Medicare is banned from covering weight loss drugs, and only 13 states provide Medicaid coverage for such medications, limiting access for patients seeking obesity treatment.

Medicare's non-coverage policy stems in part from cost concerns: the federal government estimates that covering these drugs could cost $25 billion for Medicare and $11 billion for Medicaid over the next decade.

(BBC)

5) Pharma Giants Race to Develop Next Weight Loss Drug

Multiple pharmaceutical companies, including Novo Nordisk, Eli Lilly, Amgen, and Viking Therapeutics, are developing next-generation weight loss drugs to improve upon existing GLP-1 treatments like Ozempic and Wegovy.

The race for the next generation of weight loss medications includes both injectable and oral treatments, with companies seeking to achieve weight loss percentages above 20% while minimizing side effects and patient discomfort.

The weight loss drug market has transformed Novo Nordisk and Eli Lilly into the world's most valuable pharmaceutical companies, driving intense competition to develop more effective treatments.

The global market for weight loss medications is projected to reach $105 billion by 2030, with nearly 10% of the U.S. population expected to use these treatments by 2035.

(Quartz)

6) Lilly Previews Upcoming Weight Loss Innovations

Eli Lilly is developing an oral weight loss pill called orforglipron, which could potentially match the effectiveness of Ozempic by helping patients lose approximately 14.7% of their body weight in clinical trials.

The company hopes to have the pill available to consumers in early 2026, targeting the massive global obesity market of over one billion people.

In addition to the pill, Lilly is working on retatrutide, a powerful 'triple agonist' weight loss shot nicknamed 'King Kong' that could help patients lose up to 24% of their body weight in one year, potentially rivaling the effects of bariatric surgery.

The company's ultimate long-term goal is to develop a once-per-year weight loss injection that patients could receive during an annual doctor's visit, eliminating the need for weekly injections or daily pill regimens.

GLP-1 Industry Intel

FDA Approves Ozempic for Chronic Kidney Disease: the FDA approved Novo’s Ozempic for treatment of Type 2 diabetes patients suffering from chronic kidney disease – a common comorbidity of diabetes.

Eli Lilly Veteran Joins Kailera as Commercial Chief: Kailera Therapeutics has appointed Jamie Coleman, previously a key leader for Zepbound at Eli Lilly, as its new Chief Commercial Officer.

Hims & Hers Launches Super Bowl Weight Loss Ad: Telehealth provider Hims & Hers will advertise compounded weight loss medications during the Super Bowl, positioning itself as a more accessible alternative to pricey branded drugs.

Versant Backs Helicore's Novel Obesity Drug Approach: Versant Ventures co-led a $65 million Series A investment in Helicore Biopharma, a biotech startup developing an innovative antibody drug that blocks GIP, a gut hormone potentially linked to weight management.

Virta Health Eyes IPO with Obesity Drug Strategy: In a strategic move to boost revenue, reach profitability, and prepare for potential public offering, Virta Health is prescribing weight loss medications alongside its diabetes-reversal program.

Allurion Tests Gastric Balloon with GLP-1 Drugs to Preserve Muscle: Allurion Technologies seeks to test whether its gastric balloon can mitigate muscle mass loss for patients using GLP-1 weight loss drugs.

Food & Wellness Industry Intel

GLP-1 Medications Drive Protein-Packed Yogurt Sales: Danone's yogurt sales are experiencing significant growth among GLP-1 drug users, with protein-packed and low-sugar brands like Oikos seeing a 40% retail sales surge in 2024.

Weight Loss Drugs Reshape Food Industry Landscape: A new PwC report argues that GLP-1 weight loss drugs will dramatically impact food and beverage markets, with consumers likely to spend less, eat smaller portions, and choose healthier food options.

GLP-1 drugs and certain foods can induce satiety by activating hormones like GLP-1, PYY, and CCK, with proteins and dietary fiber playing a key role in keeping people full.

Plant-based meat producers are working to counter perceptions of being ultraprocessed by highlighting potential health advantages, lower environmental impact, and simplified ingredients.

GLP-1 Drugs Spark Holistic Weight Loss Clinic Boom: The emergence of GLP-1 drugs has sparked a new wave of investment in obesity treatment startups that offer integrated, personalized healthcare approaches beyond traditional medical interventions.

Frontline Focus

Pharmacy Leaders Demand Stricter Weight Loss Medication Rules: The National Pharmacy Association is urging tougher rules for online weight loss medication sales, highlighting concerns about inappropriate prescribing and patient safety risks.

As demand for GLP-1 weight loss medications soars, compounded versions proliferate despite FDA safety concerns and potential dosing errors.

States Wrestle with High Costs of Weight Loss Drugs: As obesity rates climb, states like North Carolina and West Virginia have cut coverage for GLP-1 weight loss medications, while others like Illinois and Connecticut continue to provide the drugs despite significant expenses.

Colorado plans to cut insurance coverage for weight loss drugs like Wegovy and Ozempic for state employees to save nearly $17 million amid a significant budget shortfall.

Doctors Demand Priority Access to Obesity Meds for High-Risk Patients: A new survey reveals that 73% of doctors believe high-risk patients should get priority access to obesity medications like semaglutide and tirzepatide, highlighting potential lifesaving benefits and prevention of chronic diseases.

Younger Doctors Prescribe Newer Diabetes Medications More: A study reveals younger physicians are more likely to prescribe newer diabetes medications like GLP-1 RAs and SGLT2 inhibitors compared to more experienced physicians.

GLP-1 Clinical Insights

GLP-1 Drugs Cause Significant Muscle Mass Loss: New research shows GLP1 medications lead to significant lean mass loss, with about 30% of total weight reduction attributed to lean mass loss.

Scientists Discover Key Muscle Mass Regulation Mechanism: A new study reveals BCL6's key function in preserving muscle mass by regulating growth hormone signaling and responding to nutrient availability.

Enobosarm Helps Maintain Muscle During Weight Reduction: Veru's Phase 2b QUALITY clinical study demonstrated that enobosarm significantly reduced lean mass loss and improved body composition in older patients receiving Wegovy for weight reduction.

GLP-1 Drugs Reduce Pregnancy Risks: A retrospective cohort study found that women who used GLP-1 meds prior to pregnancy experienced decreased risks of gestational diabetes, hypertensive disorders, preterm delivery, and C-sections.

Researchers also found that GLP-1 meds show promising potential for treating obesity and metabolic symptoms in Polycystic Ovary Syndrome patients, with notable weight loss and fertility improvements.

Weight Loss Drives A1C Improvement with GLP-1 Drugs: A comprehensive analysis of 256 type 2 diabetes patients shows that weight loss, rather than intrinsic medication effects, is the main mechanism by which GLP-1 RAs improve glycemic control and cardiovascular risk factors.

The Bleeding Edge

AI Revolutionizes Diabetes Drug Development: ImmunoPrecise Antibodies is using AI to design innovative GLP-1 therapies that could transform diabetes treatment through genetic engineering and non-invasive delivery methods.

Engineered GLP-1 Analogue Shows Improved Manufacturability: Researchers engineered a highly scalable, long-acting GLP-1 analogue by conjugating a C-16 fatty acid to lysine, achieving improved bio-efficacy and production yields.