The Gut Punch Weekly #29

Medicare plans trial coverage for obesity drugs, GLP-1 opportunities amid foodtech slump, Novo continues taking L's, Lilly's new oral GLP-1 is pretty mid, and more!

Top Stories

1) Medicare Plans Trial Coverage for Obesity Drugs

The Trump administration is considering a five-year experiment to allow Medicare and Medicaid to cover GLP-1 drugs for obesity, potentially starting in 2026 for Medicaid and 2027 for Medicare.

This proposal comes after the HHS rejected a Biden administration plan in April that would have cost nearly $40 billion over 10 years.

While Medicare already covers GLP-1s for diabetes and heart disease, only 13 states currently cover these drugs for obesity through Medicaid.

Insurers have been resistant to expanding coverage for these drugs, which can cost over $1,000 per user per month.

HHS Secretary Robert F. Kennedy Jr. has shifted his stance on GLP-1 drugs, now calling them "miracle drugs" for obesity and diabetes, but emphasizing they should be prescribed alongside exercise.

(Axios)

2) Siddhi Capital Invests in GLP-1 Opportunities Amid Foodtech Slump

The foodtech investment climate is challenging, with generalist investors retreating and VC funds struggling to raise capital.

Siddhi Capital is adapting by prioritizing "financing risk first" and focusing on companies that can do more with less.

Siddhi sees GLP-1 drugs as a major opportunity, comparable to AI's impact, with potential in areas like companion foods, drug alternatives, and specialized meal plans.

The firm is also interested in AI applications for bioprocess exploration and extending lean teams in CPGs.

Siddhi also notes that a new wave of leaner, smarter startups is emerging in sectors like cultivated meat and animal-free dairy, focusing on high-value products and differentiation within a maturing ecosystem.

3) Novo Nordisk Struggles Despite Ozempic Success

Novo Nordisk's Ozempic became a cultural phenomenon, attracting celebrity use and viral TikTok videos, leading to predictions of tapping into a massive obesity market.

However, supply shortages opened the door for compounded versions, which the company has struggled to stop despite legal action.

The company's slow response to competition, including delayed introduction of a direct-to-consumer platform and less effective oral weight loss medications, has hurt its market position.

Analysts have downgraded the stock, citing these challenges and Eli Lilly's superior product offerings.

Concerns are growing about overestimation of the weight-loss market size and potential political pressure on drug pricing.

These factors, combined with Novo Nordisk's struggles, have led to a dramatic reversal in investor sentiment towards the once-dominant company.

4) Lilly's Oral GLP-1 Shows 12% Weight Loss in Trials – Meh

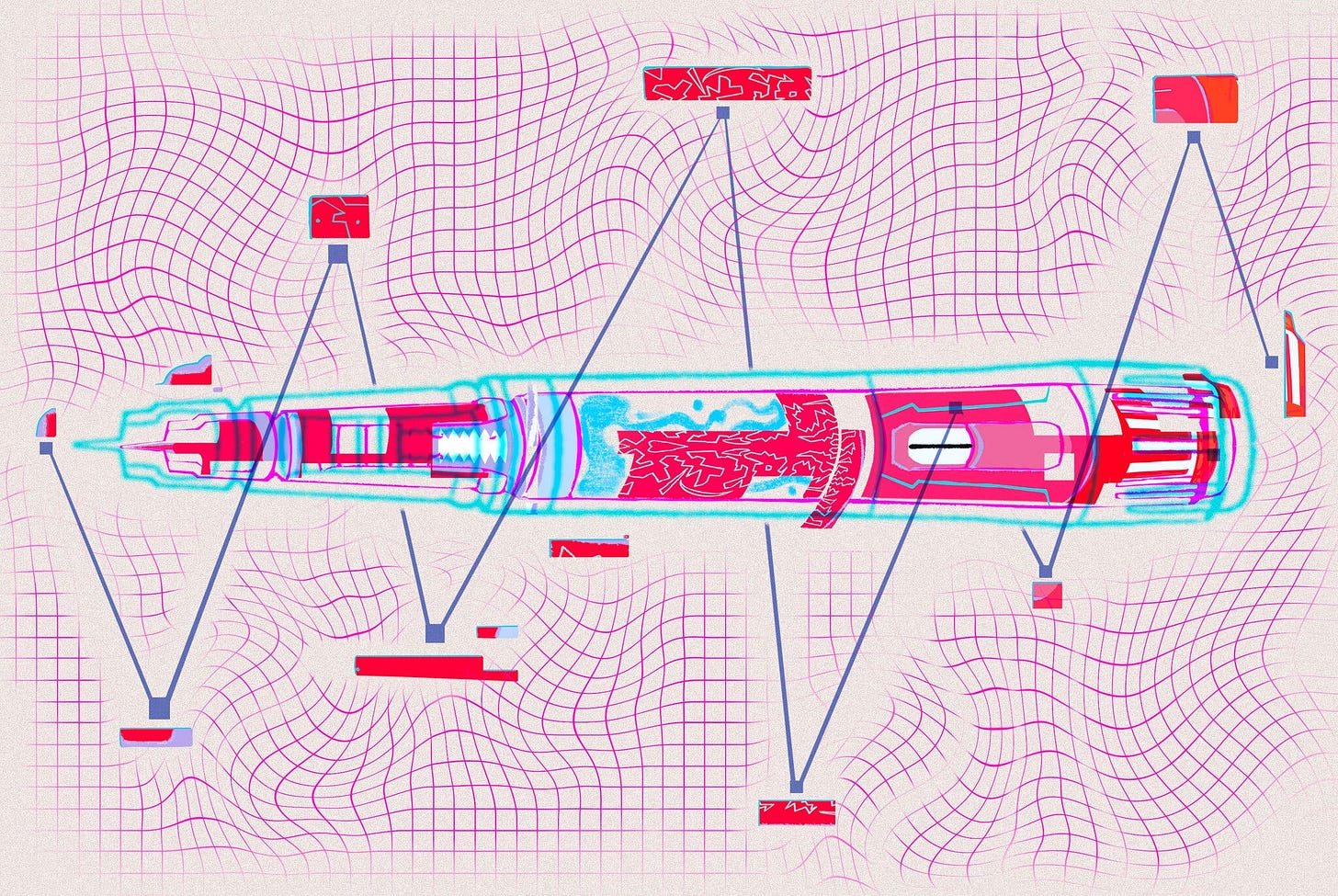

Eli Lilly's oral GLP-1 receptor agonist orforglipron demonstrated significant weight loss in a phase 3 trial, with the highest dose (36 mg) resulting in 12.4% (27.3 pounds) average weight loss at 72 weeks.

The drug met its primary endpoint across all dosage groups, showing potential as a once-daily oral treatment for obesity.

Lilly plans to submit regulatory applications by the end of 2025, positioning orforglipron as a potential alternative to injectable GLP-1 drugs.

However, Lilly’s oral GLP-1’s efficacy appears lower than injectable counterparts like Zepbound and Wegovy, which have demonstrated higher weight loss percentages in their respective trials.

GLP-1 Industry Intel

Mounjaro Matches Trulicity in Cardiovascular Safety Study: Lilly's dual-action diabetes drug Mounjaro matched Trulicity's cardiovascular benefits in a phase 3 trial, strengthening its position as a potential front-line treatment for Type 2 diabetes patients with heart disease.

Investors Sue Novo Nordisk Over Wegovy Revenue Forecast Cuts: Danish pharmaceutical giant Novo Nordisk has been hit with a class action lawsuit after investors lost $70 billion in market value due to lowered sales projections for their weight-loss drug Wegovy.

Pfizer Abandons Final GLP-1 Drug Amid Competition: Pfizer has discontinued its third and final GLP-1 agonist obesity drug candidate due to poor phase 1 data and competitive market pressures, leaving their obesity program significantly diminished.

Madrigal Acquires CSPC's GLP-1 for $2B in MASH Deal: Madrigal Pharmaceuticals has secured a $2 billion deal with CSPC Pharmaceutical for global rights to a preclinical GLP-1 drug that they plan to combine with their MASH treatment Rezdiffra.

Novo Nordisk Warns of Layoffs Amid Wegovy Competition: Novo Nordisk warns of possible layoffs and slower growth as copycat Wegovy drugs and U.S. competition erode sales and market share.

Noom Launches Affordable Microdose GLP-1 Weight Loss Program: Noom's new Microdose GLP-1Rx program aims to overcome barriers to GLP-1 adoption by offering lower doses of medications like Wegovy, starting at $119 for the first month.

Food & Wellness Industry Intel

Ex-X Chief Linda Yaccarino Leads GLP-1 Telehealth Startup: Former X CEO Linda Yaccarino has been appointed CEO of eMed Population Health, a telehealth startup specializing in GLP-1 medications for diabetes and obesity.

GLP-1 Weight Loss Drugs Alter European Eating Habits: GLP-1 weight-loss drugs are gaining traction in Europe, with UK households doubling usage to 4.1%, though users are making fewer dietary changes than traditional dieters.

Experts Warn Against Unregulated GLP-1 Supplement Claims: Experts warn that unregulated GLP-1 supplements are ineffective and potentially misleading compared to prescription medications like Ozempic and Wegovy.

Restaurants Adapt Menus for GLP-1 Users with Mini Portions: From Clinton Hall's 'teeny-weeny mini meals' to Smoothie King's dedicated GLP-1 menu, restaurants are responding to the growing appetite-suppressing drug trend with smaller portions and specialized offerings to maintain business.

Frontline Focus

EU Tariffs Likely to Increase Ozempic, Wegovy Prices: A new 15% EU import tariff may raise U.S. prices for popular weight loss drugs Ozempic and Wegovy, impacting patients who already face high medication costs.

U.S. Needs National Strategy for GLP-1 Access: The U.S. needs a revolutionary overhaul of its approach to GLP-1 medications, including better insurance coverage, pricing reforms, and federal oversight to maximize their impact on public health.

Doctors Prioritize Lifestyle Changes Over Weight Loss Drugs: Despite the rise of GLP-1 medications for obesity treatment, many physicians continue prioritizing lifestyle interventions due to concerns about medication adherence, cost barriers, and long-term sustainability.

GLP-1 Clinical Insights

Ozempic Slows Aging, Could Reverse Biological Age: A clinical trial found Ozempic can reverse biological age by an average of 3.1 years through its impact on fat distribution and inflammation.

Ozempic May Reduce Stroke Risk and Brain Damage: Three new studies suggest that GLP-1 drugs like Ozempic may offer significant brain protection benefits, including lower stroke mortality rates and reduced risk of cognitive decline.

Weight Loss Drugs May Boost Men's Testosterone Levels: A new study from St. Louis University Hospital found that GLP-1 weight loss medications like Ozempic and Wegovy may significantly increase testosterone levels in men with obesity or Type 2 diabetes.

Study Finds No Increased Retinopathy Risk from GLP-1 Drugs: A large-scale Mayo Clinic study of nearly 160,000 diabetes patients found no significant differences in retinopathy risk between various GLP-1 medications, contradicting previous concerns about these drugs' impact on eye health.

GLP-1 Agonists Lower Dementia Risk More Than Metformin: A new study reveals GLP-1 receptor agonists reduce overall dementia risk by 10% compared to metformin in type 2 diabetes patients, with particularly strong benefits for Alzheimer's disease and older adults.

The Bleeding Edge

Amylin Shows Promise as Next Weight Loss Drug: Major pharmaceutical companies are investing heavily in amylin-based drugs for obesity treatment, with some showing up to 23% weight loss in trials and potentially fewer side effects than current GLP-1 agonists.

Ozempic Muscle Loss Smaller Than Previously Thought: Recent research in mice indicates that muscle loss from GLP-1 drugs may be lower than earlier estimates, showing a 10% decrease in lean muscle mass with some of the reduction coming from liver tissue rather than skeletal muscle.