The Gut Punch Weekly #21

Novo's CEO gets the boot, compounders exploit a loophole to keep selling GLP-1 knockoffs, a conversation with the founder of SuperGut, and more!

Prescience or Providence? The SuperGut Story

What separates a truly transformative health brand from the endless sea of wellness products promising to cure all maladies?

Why do some founders build category-defining companies, while others with nearly identical ingredients fade into obscurity?

And what happens when years of scientific groundwork suddenly collide with a metabolic revolution that completely reshapes people's relationships with food?

In case you haven't noticed, fiber and GLP-1s are both having major cultural moments. And SuperGut, whether through prescience or providence, spent years developing gut-healthy fiber blends and conducting gold-standard clinical trials – long before Ozempic became a household name.

I recently joined Alex Shandrovsky, host of the Investment Climate Podcast, for a conversation with Marc Washington, founder and executive chairman of SuperGut.

Our discussion digs into the balancing act between scientific rigor and market momentum, the hard decisions around investing in clinical validation versus splashy marketing, and what it takes to carve out real differentiation in a world where a new “natural GLP-1” copycat emerges every week.

And as Marc transitions from CEO to Executive Chairman, we tackle the ultimate question that haunts every founder as they hand over the reins: how will you know whether you've built an enduring brand that will stand the test of time?

An Interview with Marc Washington – Founder & Executive Chairman of SuperGut

Top Stories

1) Novo Nordisk CEO Ousted in Surprise Leadership Shake-Up

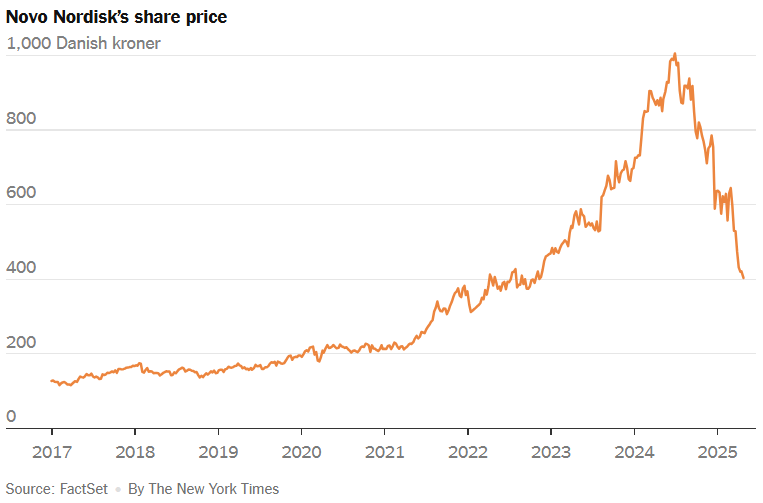

Novo Nordisk, maker of popular weight-loss drugs Ozempic and Wegovy, announced it will replace CEO Lars Fruergaard Jorgensen after 8 years due to a 50% stock decline in the past year.

The company has been dethroned by a combination of lower-cost compounded versions of its drugs and fierce competition from Eli Lilly's Mounjaro and Zepbound.

Despite Novo Nordisk's earlier market entry and previous dominance (it was once valued higher than Denmark's GDP), the company now faces an uncertain future in the increasingly competitive weight-loss drug market.

Meanwhile, Eli Lilly is developing new weight-loss drugs, including a daily pill, which are expected to drive blockbuster sales for years to come.

(NYTimes)

2) Compounders Tweak Formulas to Keep Selling Ozempic Alternatives

Compounding pharmacies and telehealth companies are using legal loopholes to continue offering cheaper alternatives to GLP-1 drugs by tweaking formulations, changing dosages, or adding vitamins.

The market for compounded versions of popular weight-loss drugs like Ozempic exploded in 2023-2024 due to shortages of the brand-name drug..

Patients report experiencing frequent changes in their medication formulations, sometimes without direct consultation with medical providers.

While some express concerns about these changes, many continue to prefer the compounded versions due to their lower cost and perceived effectiveness.

Drugmakers like Novo Nordisk and Eli Lilly are fighting back with lawsuits against businesses marketing compounded versions of their drugs, alleging mass production under the guise of personalized options.

(WSJ)

GLP-1 Industry Intel

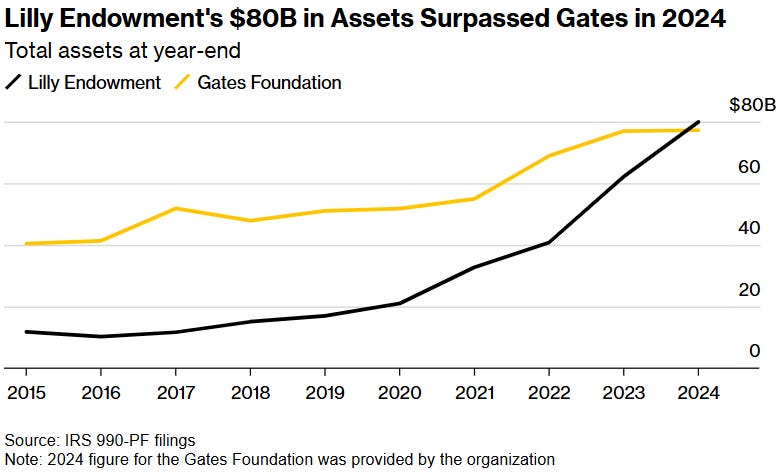

Lilly Endowment Surpasses Gates as Largest US Foundation: Fueled by the success of weight-loss drugs Zepbound and Mounjaro, the Lilly Endowment's assets grew 29% to $79.9 billion in 2024, making it the largest private foundation in the United States.

Novo Nordisk Bets $2.2B on Septerna's Obesity Drug Treatment Programs: Novo Nordisk will pay up to $2.2 billion to acquire rights to Septerna’s preclinical oral obesity drugs, which are designed to target multiple incretin receptors.

Telehealth Startups Turn to Generic Liraglutide Amid Restrictions: After losing access to compounded Ozempic, telehealth startups are turning to older, less effective generic liraglutide for weight loss, despite its lower efficacy and daily injection requirement.

Scripta Launches GLP-1 Navigator for Weight Loss Guidance: Scripta Insights launched the GLP-1 Navigator app feature to help Americans navigate complex weight loss drug options amid shifting insurance coverage.

Food & Wellness Industry Intel

Chobani Buys Daily Harvest, Expands Into Plant-Based Meals: Chobani has acquired plant-based meal startup Daily Harvest marking its expansion into plant-based and ready meal categories.

Noom Offers Smaller, Personalized Doses Amid Wegovy Compounding Crackdown: Online weight-loss company Noom is shifting to offer smaller, personalized doses of compounded semaglutide as a loophole to get around FDA regulations that restrict sale of compounded Wegovy.

Ozempic Users Boost Meat Sales, JBS Reports: GLP-1 weight-loss drugs are driving increased US meat and protein demand as users seek to maintain muscle mass, benefiting meat producers like JBS.

Vitamin Shoppe Launches Products for GLP-1 Users: The Vitamin Shoppe is launching products for GLP-1 weight loss drug users that help manage the drug's side effects.

GLP-1 Drugs' Impact on Food Industry Still Limited: Mintel research reveals that 25% of UK consumers are interested in injectable weight-loss drugs but argues that food brands should adapt gradually by focusing on existing trends like portion control and nutrient density.

GLP-1 Trend Sparks Functional Food and Supplement Innovation: Major food and supplement companies are launching GLP-1-supportive products containing specific ingredients like resistant starch, polyphenols, and fiber blends to target appetite control and metabolic wellness.

Restaurants Adapt Menus for GLP-1 Weight Loss Users: Restaurants are responding to the rise of GLP-1 drug usage by developing menus featuring smaller portions, protein-rich options, and low-sugar alternatives to appeal to the changing appetites of consumers.

Food Industry Targeting Growing GLP-1 Market with Nutrient-Dense Foods: As GLP-1 medications gain popularity, food manufacturers are focusing on nutrient-dense ingredients rich in protein and fiber to appeal to users seeking satiety and digestive health support.

Tariffs and GLP-1 Drugs Reshape CPG Brand Strategies: CPG brands face rising tariffs and shifting consumer demand from weight loss drugs, forcing rapid adaptation in supply chains, ingredients, and product innovation to stay competitive.

Frontline Focus

Metabolic Health Could Add 6.5 Billion Years of Life Globally: A McKinsey report suggests that prioritizing overall metabolic health, rather than just obesity care, could add 6.5 billion years of life globally and lead to a $5.65 trillion annual GDP uplift by 2050.

Newsom Proposes Cutting Medi-Cal Coverage for Obesity Drugs: California Governor Gavin Newsom, citing the state's $12 billion budget deficit, proposed ending Medi-Cal coverage for weight loss drugs Ozempic and Wegovy by 2026 in order to save up to $680 million.

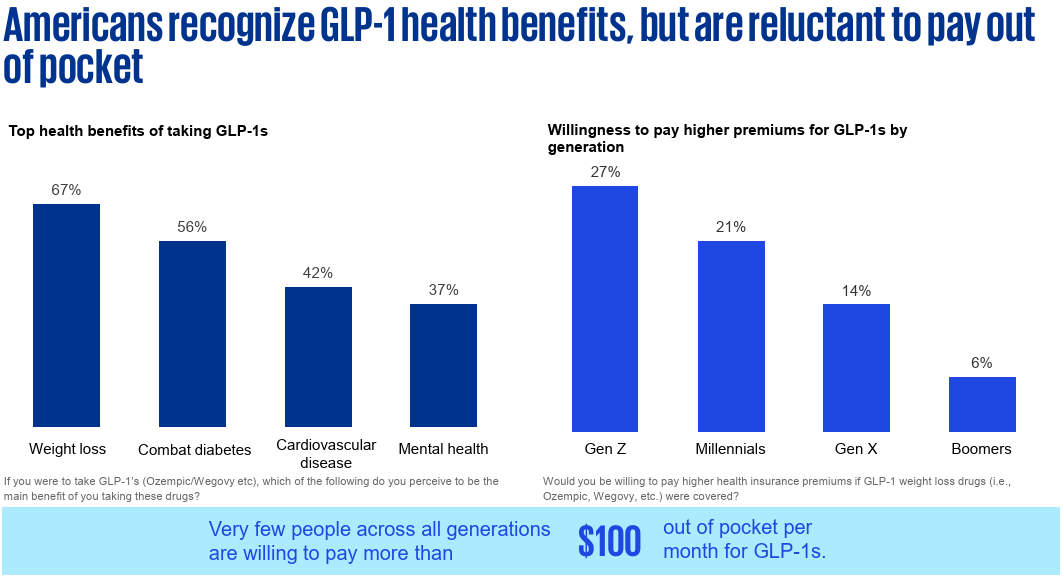

Most Consumers Won't Pay Over $100 for GLP-1 Drugs: A KPMG survey found most consumers are unwilling to pay more than $100 out-of-pocket per month for GLP-1 drugs despite recognizing their weight loss benefits.

GLP-1 Weight Loss Drives Surge in Aesthetic Treatments: The surge in GLP-1 weight loss drug use is driving a wave of new patients to seek medical aesthetic treatments, especially for post-weight-loss facial concerns.

How Physicians Can Guide Non-Compliant Weight Loss Patients: Medical professionals must balance patient demands for GLP-1 RA weight loss medications with proper screening, insurance considerations, and comprehensive treatment plans that include lifestyle changes.

GLP-1 Clinical Insights

GLP-1 Weight Loss Drugs More Effective in Women: Scientists are investigating why women respond better to GLP-1 weight loss drugs than men, with emerging evidence suggesting estrogen may play a crucial role in enhancing the medications' effectiveness.

GLP-1 Drugs Reduce Risk of AFib Recurrence in Diabetics: A VA study found that GLP-1 agonists reduced the risk of atrial fibrillation recurrence by 13% compared to other diabetes medications in patients with obesity and diabetes.

Comparing Weight Loss Efficacy of Popular Diabetes Medications: Meta-analysis of GLP-1 receptor agonists showed Tirzepatide's superiority over Semaglutide in HbA1c reduction while Semaglutide outperformed Dulaglutide and Liraglutide in glycemic control.

Vida Health Achieves Weight Loss Without Expensive Medications: New data from Vida Health shows that one-third of their members achieve 5% weight loss within 90 days without using GLP-1 medications.

The Bleeding Edge

GLP-1 Drugs Activate AMPK, Mitigate Alzheimer's Symptoms: Researchers discovered that GLP-1 receptor agonists combat Alzheimer's disease by enhancing AMPK signaling, which reduces harmful protein production and promotes debris clearance in brain cells.