The Gut Punch Weekly #15

Trump blocks Medicare coverage of weight loss drugs, Novo Nordisk invests $1.1B in Brazil production, Ozempic may help cut food costs and waste, and more!

Top Stories

1) Trump Blocks Medicare Coverage of Weight Loss Drugs

The Trump administration has reversed a Biden-era proposal to expand Medicare coverage for anti-obesity drugs, including GLP-1s like Wegovy and Ozempic.

This decision maintains the longstanding prohibition on covering weight loss drugs, despite arguments that it could make these medications more accessible and potentially reduce obesity-related illnesses.

The scrapped proposal to cover anti-obesity drugs under Medicare would have cost the government nearly $40 billion over 10 years.

The Trump administration's decision not to cover obesity medications under Medicare and Medicaid has drawn heavy criticism from medical societies and healthcare organizations.

In a NYT opinion piece, Sen. Fetterman shares his positive experience with Mounjaro and argues for Trump to reverse course on his decision to block Medicare and Medicaid coverage of GLP-1 drugs.

Meanwhile, insurers are taking a victory lap after strongly lobbying against coverage of GLP-1 drugs.

The Trump administration's decision to exclude weight-loss drugs from Medicare coverage has led to substantial stock declines for Eli Lilly and Novo Nordisk.

(Axios)

2) Novo Nordisk Invests $1.1B in Brazil Production

Novo Nordisk is investing $1.09 billion to expand production capacity for injectable drugs, including Ozempic and Wegovy, at its facility in Minas Gerais, Brazil.

The expansion will significantly increase production capacity, and operations in the new 74,000 square meter facility are expected to begin in 2028.

Brazil is among Novo Nordisk's top five markets globally, and the company exports to over 70 countries from its Brazilian operations.

Novo is forging ahead with its investment despite a number of Brazilian pharmaceutical companies preparing to enter the GLP-1 market with generic versions of semaglutide.

(Reuters)

3) Ozempic May Help Cut Food Costs and Waste

GLP-1 users reported dietary shifts towards more produce, fish, and healthy fats, while reducing alcohol, dairy, sweets, and carbs.

Consumers on these medications reported significant cost savings on food, with 40% able to offset their medication costs through reduced food expenditures.

This change in eating habits, particularly increased vegetable consumption, was also associated with lower likelihood of food waste.

GLP-1 Industry Intel

Lilly Sues Indianapolis Spa for Repackaging Zepbound: Eli Lilly has filed a lawsuit against Indianapolis-based Premier Weight Loss spa for allegedly breaking open and repackaging Zepbound autoinjector pens into lower, unsterile doses.

Hims & Hers Adds Zepbound to Weight Loss Lineup: Hims & Hers has expanded its weight-loss offerings by adding Eli Lilly's Zepbound and generic liraglutide, although Lilly claims no affiliation with the telehealth platform.

Eli Lilly Grows Direct-to-Consumer Weight Loss Services: As the direct-to-consumer weight loss medication market intensifies, Eli Lilly has expanded LillyDirect through partnerships with knownwell and other digital health providers.

Obesity Drug Pioneers Win $3M Breakthrough Prize: The scientists responsible for the development of GLP-1-based weight-loss drugs Ozempic and Wegovy have been awarded the $3 million Breakthrough Prize.

Competition, Not Regulation, Solved GLP-1 Drug Shortage: Market forces successfully addressed the GLP-1 drug shortage by enabling competition through FDA's temporary patent suspension, though now that the crisis is resolved the FDA is cracking down on drug compounders.

Food & Wellness Industry Intel

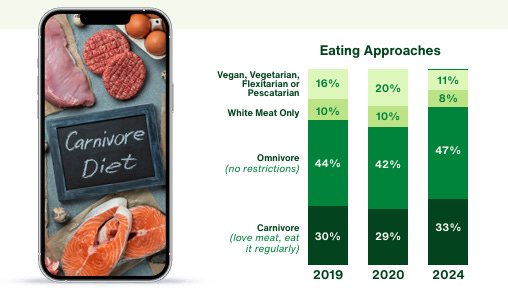

Weight Loss Drugs Could Reshape Meat Industry: The rise of weight-loss drugs like Wegovy could pose a serious threat to the meat industry as users report eating 20-25% less food overall and actively avoiding heavy, meat-laden dishes.

In contrast, Cargill's 2025 Protein Profile shows a significant surge in protein consumption, particularly among social-media-influenced younger generations, with consumers heavily prioritizing animal proteins.

Side Effects Drive Supplement Demand for GLP-1 Users: Market analysis indicates growing demand for supplements that complement GLP-1 medications, particularly in addressing side effects and providing alternatives for those unable to access the drugs.

Sucralose Makes People Hungrier Than Sugar: A new study reveals that consuming the artificial sweetener sucralose increases brain activity in hunger-related regions while making participants feel three times hungrier than sugar.

CVS Partners with Omada on Weight Loss Program: CVS Caremark has partnered with Omada Health to launch a comprehensive weight management program that combines GLP-1 medications with lifestyle support and clinical oversight.

Revita Shows Promise for Post-GLP-1 Weight Maintenance: Preliminary data from Fractyl Health's REVEAL-1 study indicates their Revita procedure could offer a non-pharmacologic solution for maintaining weight loss after stopping GLP-1 medications, with treated patients showing only 1.2% weight regain after one month compared to the typical 3%.

Ozempic Era Spawns Billion-Dollar Metabolic Health Industry: The integration of real-time metabolic monitoring tools with weight loss medications like Ozempic is enablishing a shift toward data-driven, personalized care that could improve treatment efficacy and reduce side effects.

Field Doctor Launches Meals for Weight Loss Drug Users: UK meal subscription service Field Doctor has launched a new range of smaller, protein-rich ready meals specifically designed for users of weight loss drugs like Ozempic and Wegovy.

Natural Supplement Targets Post-GLP-1 Weight Management: A new supplement called Control by Elénzia claims to naturally boost GLP-1 levels by 22% and reduce insulin resistance without the side effects of traditional GLP-1 drugs.

Frontline Focus

Study Shows Ozempic Users Face Weight Loss Stigma: Americans view Ozempic-assisted weight loss as less admirable than diet and exercise alone, according to a University of Oxford study of over 1,000 Americans.

Ozempic's Complex Impact on Eating Disorders: While Ozempic and similar GLP-1 drugs show promise in treating binge eating disorders, experts worry about their potential to trigger restrictive eating disorder relapse.

Endocrinology Staff Need Better Training on Diabetes Drugs: A study of 265 endocrinology medical staff has revealed gaps in knowledge about liraglutide and semaglutide medications.

GLP-1 Clinical Insights

Weight Returns After Discontinuing GLP-1 Medications: A new meta-analysis reveals that discontinuing GLP-1RA medications results in substantial weight regain regardless of lifestyle interventions, indicating these drugs require continuous use for sustained weight management.

Ozempic May Reduce Dementia Risk: A meta-analysis of 26 clinical trials reveals that GLP-1 drugs like Ozempic and Wegovy could significantly reduce dementia risk, possibly by reducing inflammation and protecting cardiovascular health.

Eating Behaviors Impact Semaglutide Weight Loss Results: Research using the Aviitam digital platform revealed that patients with lower anxiety/depression and higher intuitive eating scores achieved greater weight loss with semaglutide compared to those with opposite characteristics.

Metformin Shows Protective Effect Against Bone Loss: A study found that Metformin significantly reduces osteoporosis risk while Gliclazide increases fracture risk, and GLP-1 receptor agonists, SGLT2 inhibitors, and insulin show minimal effects on bone health.

The Bleeding Edge

Rare Sugars Show Promise For Appetite Control: Scientists discovered that certain rare sugars, particularly D-allulose and other ketohexoses significantly increased GLP-1 hormone levels and decreased food consumption in mice.