The Gut Punch Weekly #13

Snack sales are on the decline, Wegovy prices now lower for cash buyers, Lilly beats Novo to Indian market, Novo spends $200M to license "triple agonist" drug, and more!

Insurer-Controlled Middlemen Are Behind High Drug Costs

In last month's investigation, we exposed the devastating impact of the FDA's decision to end access to compounded GLP-1 alternatives, forcing millions of Americans to confront the shocking reality of $1,000+ monthly price tags for brand-name weight loss and diabetes medications.

We explained how manufacturers set astronomical list prices, how other countries pay a fraction of what Americans pay, and how insurers rarely cover these drugs for obesity despite their proven effectiveness.

But there's another critical piece to this affordability puzzle: the hidden middlemen.

The Hidden Layer

While pharmaceutical manufacturers like Novo Nordisk and Eli Lilly certainly bear responsibility for setting high list prices for drugs like Ozempic, Wegovy, Mounjaro, and Zepbound, a complex and opaque network of intermediaries – particularly Pharmacy Benefit Managers (PBMs) – wields extraordinary influence over what patients ultimately pay and whether they can access these medications at all.

Drugmakers argue that U.S. prices are high because of the unique American system of rebates and middlemen. In a 2024 Senate hearing, Novo Nordisk’s CEO testified that “we pay 75 cents of every dollar of medicine we sell back into this complex system in rebates, discounts, and fees.” 1 In other words, only 25% of the gross revenue from Ozempic/Wegovy might actually be kept by Novo Nordisk; the rest is absorbed by intermediaries in the supply chain.

That “complex system” includes PBMs negotiating rebates, insurers and Third-Party Administrators (TPAs) administering plans, and brokers steering employer insurance plan decisions. Each intermediary takes a slice.

But curiously, these middlemen may not be as disparate and independent as they seem at first glance. They very often answer to the same “higher power.” You won’t be surprised to learn the identity of the man behind the curtain: it’s health insurers.

How much longer can this elaborate chain of insurer-controlled profiteers hold out against an increasingly desperate public that is losing GLP-1 coverage and on the financial brink?

Read our full story about how Insurer-Controlled Middlemen Are Behind High Drug Costs.

Top Stories

1) Food Giants Report Major Decline in Snack Sales

General Mills reported a 5% drop in net sales and a mid-single digit decline in U.S. snacks sales, attributing the slowdown to reduced consumer confidence.

Other major food companies like J.M. Smucker and Campbell's also experienced sales declines in their snack categories, hinting at a broader industry trend.

The snacking recession is driven by years of inflation, leaving consumers frustrated with food price increases and cautious due to economic uncertainty.

This shift in consumer behavior is forcing packaged food companies to reevaluate their strategies and potentially innovate or cut prices to stimulate sales.

While some speculate that weight-loss drugs might be contributing to reduced snacking, most executives believe a more comprehensive change in consumer spending habits is afoot.

For instance, the trend extends beyond human snacks to a decline in dog treat sales.

(Axios)

2) Weight Loss Drug Wegovy Now Cheaper for Cash Buyers

Novo Nordisk has expanded its discounted Wegovy program, offering all eligible cash-paying customers the weight-loss medication at $499 per month for any dose.

This marks a significant reduction from the previous $650 monthly cost for self-pay patients.

While Lilly offers its Zepbound at similar price points through its own pharmacy solutions, Novo's move to include traditional retail channels broadens access.

Both companies are battling for market share in the potentially lucrative weight-loss medication sector, with Novo's latest move potentially giving it an edge.

3) Lilly Beats Rival Novo to Indian Market

Eli Lilly has launched its blockbuster diabetes and weight-loss drug Mounjaro in India, beating rival Novo Nordisk to the market.

Local drugmakers are also racing to develop generic versions of these GLP-1 receptor agonists, aiming to capture a share of the global market estimated to be worth $150 billion in the next decade.

This launch gives Lilly a first-mover advantage in addressing India's growing obesity and diabetes challenges.

Adult diabetes cases in India are projected to increase from 74.2 million in 2021 to over 124 million by 2045.

(Reuters)

4) Novo Spends $200M to License Chinese Triple-Acting Obesity Drug

Novo Nordisk has licensed a new 'triple agonist' obesity drug from China-based United Laboratories for $200 million upfront, potentially paying up to $1.8 billion more in milestones.

The drug, UBT251, is a "triple agonist" that targets GLP-1, GIP, and glucagon.

In early trials, UBT251 demonstrated a 15.1% average weight loss over 12 weeks, with a side effect profile similar to existing GLP-1 drugs.

This deal expands Novo's obesity pipeline as competition intensifies with Eli Lilly's Zepbound, which is gaining market share and demonstrating superior weight loss outcomes versus Wegovy.

GLP-1 Industry Intel

Online Pharmacies Defy FDA's Zepbound Copycat Ban: Online pharmacies are defying the FDA's ban on compounding Zepbound by offering personalized versions of tirzepatide that exploit legal loopholes, including by modifying dosages or adding additional ingredients.

Late Entrants Face Tough Road in GLP-1 Market: The GLP-1 weight loss drug market boom mirrors the rise of PD-1 cancer therapies, but experts warn that late entrants may struggle to succeed as they did in the PD-1 space.

Eli Lilly's Obesity Pill Data Coming Soon: Eli Lilly plans to release clinical trial data in 2025 for its experimental once-daily weight loss pill orforglipron, which could revolutionize the obesity treatment market by offering a more convenient alternative to injections.

GLP-1 Drug Spending Surpasses Specialty Drug Growth: According to a new Evernorth report, spending on GLP-1 drugs has surpassed specialty drug spending growth for the first time in 2023, with pharmaceutical spending growth accelerating from 2.1% in 2021 to 12.8% in 2024.

Quantum Health Launches GLP-1 Weight Management Program: Quantum Health and Vida Health have partnered to launch a GLP-1 weight management solution that optimizes prescribing patterns and provides comprehensive support for employers managing rising medication costs.

Food & Wellness Industry Intel

Food Companies Target Consumers Transitioning Off Weight-Loss Drugs: As early GLP-1 drug users begin transitioning off weight-loss medications, food and beverage manufacturers are developing products focused on high-protein, fiber-rich, and healthy-fat ingredients to help maintain weight loss and manage appetite without medication.

GLP-1 Food Product Labels Face Regulatory Uncertainty: Despite growing interest in GLP-1 weight-loss medications, companies are advised against labeling products as 'GLP-1 friendly' until federal agencies establish clear definitions.

AI-Powered Drug Dosing Platform Expands to GLP-1 Medicines: Closed Loop Medicine has secured US patents for its AI-powered precision dosing platform, enabling entry into the GLP-1 weight loss drug market and expanding its digital-drug solutions for cardiometabolic conditions.

ChipMonk Launches Cookie Claiming to Boost GLP-1 Hormone: ChipMonk Baking has entered the GLP-1-companion food space by launching new cookies designed to boost natural GLP-1 hormone levels through a proprietary blend of fiber, amino acids, and salts – though experts note more research is needed to prove efficacy.

Frontline Focus

Patients Scramble as FDA Halts Compounded Obesity Drugs: The imminent end of compounded tirzepatide production has patients stockpiling medication and considering risky alternatives since many cannot afford Eli Lilly's Zepbound even with available discounts.

Ozempic Success May Threaten Pension Industry Calculations: The rapid adoption of weight-loss drugs like Ozempic and Wegovy could significantly disrupt life insurance and pension companies by extending life expectancy beyond their actuarial predictions and capital reserves.

Health Groups Urge FDA to Stop Compounded GLP-1 Drugs: A coalition of 20 major health organizations is pressing the FDA to crack down on compounded versions of popular weight-loss drugs following the end of supply shortages.

GLP-1 Clinical Insights

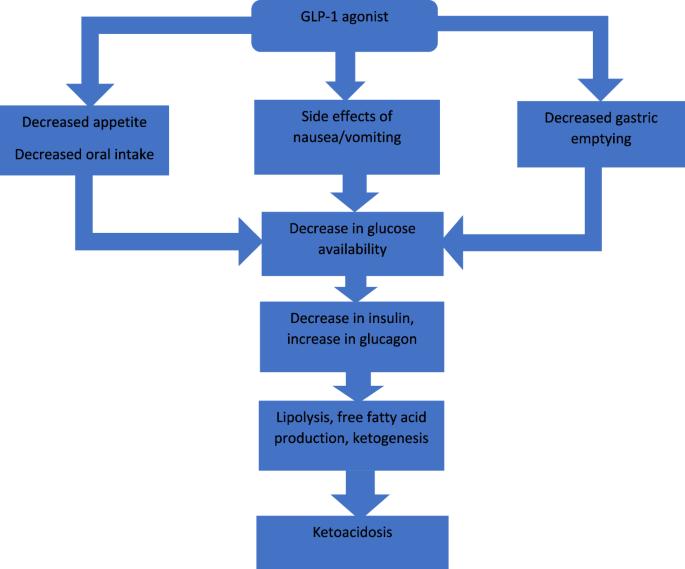

GLP-1 Drugs Can Cause Ketoacidosis in Non-Diabetics: Research reveals that semaglutide and tirzepatide can cause euglycemic ketoacidosis – a rare but serious complication – in non-diabetic patients, especially when combined with factors like poor oral intake, alcohol use, or ketogenic diets.

Semaglutide Reduces Inflammation Markers in HIV Patients: New research demonstrates semaglutide's effectiveness in lowering inflammation markers associated with morbidity and mortality in HIV patients.

Study Finds No Link Between GLP-1 Drugs and Suicide: A comprehensive meta-analysis of 144 studies found no increased risk of suicide or self-harm among people taking GLP-1 receptor agonists for diabetes or obesity compared to placebo.

Study Shows Better GLP-1 Results with Pharmacist Support: A retrospective study found that patients receiving GLP-1 agonists for weight management achieved higher rates of documented treatment success when co-managed by pharmacists compared to primary care provider management alone.

Race and Income Drive Access to Key Diabetes Medications: Despite proven cardiovascular and kidney benefits, uptake of SGLT2i and GLP-1RA medications remains suboptimal across various demographic groups, with minority populations consistently showing lower rates of initiation.

GLP-1 Analogs Superior to DPP-4 Inhibitors: Research demonstrates that pasireotide-induced hyperglycemia is primarily caused by drastic inhibition of GLP-1 secretion through SSTRs-Gi axis shutdown, suggesting GLP-1 analogs are superior to DPP-4 inhibitors for diabetes treatment.

The Bleeding Edge

Antibody Painting Could Enhance GLP-1 Drug Delivery: MIT scientists have created an innovative system that bonds GLP-1 drugs to antibodies within the body, demonstrating sustained weight loss and blood sugar control in mice with significantly reduced dosing.

Moringa Dietary Fiber Shows Promise for Diabetes Management: Researchers found that dietary fibers from Moringa oleifera leaves demonstrated significant hypoglycemic effects in both laboratory and mouse studies, with smaller particle sizes showing enhanced glucose control properties.

College Team Creates Plant-Based Ozempic Production Method: Using a process called biopharming, students have engineered a way to make plants produce pharmaceutical proteins, potentially allowing people to grow medications like Ozempic in a more scalable way.